This article was originally published on PerformLine.

From deceptive loan offers to misleading financial promotions, consumers are inundated with marketing that isn’t what it seems.

Complaints have surged, enforcement actions are on the rise, and regulators are cracking down, yet some companies still underestimate the risks.

Even in a time when federal deregulation dominates headlines, marketing compliance remains just as critical—if not more—as enforcement shifts to new players and consumer expectations rise.

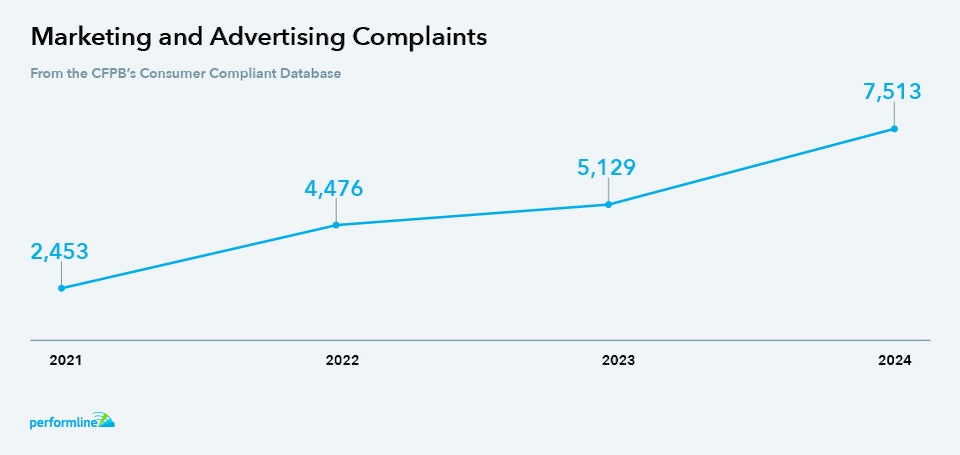

Consumer complaints have tripled in the U.S. since 2021

While the Consumer Financial Protection Bureau (CFPB)’s future remains uncertain, its Consumer Complaint Database tells an important story.

Complaints related to misleading marketing and advertising have tripled since 2021, with an average increase of 48% year over year.

Specifically, consumers most often complain about:

- Receiving false or misleading information about loans and financial products

- Not receiving advertised or promotional terms as promised

- Experiencing confusing or deceptive marketing tactics

These complaints highlight the continued presence of unfair and deceptive practices in financial services, reinforcing the importance of marketing compliance—even if enforcement priorities shift.

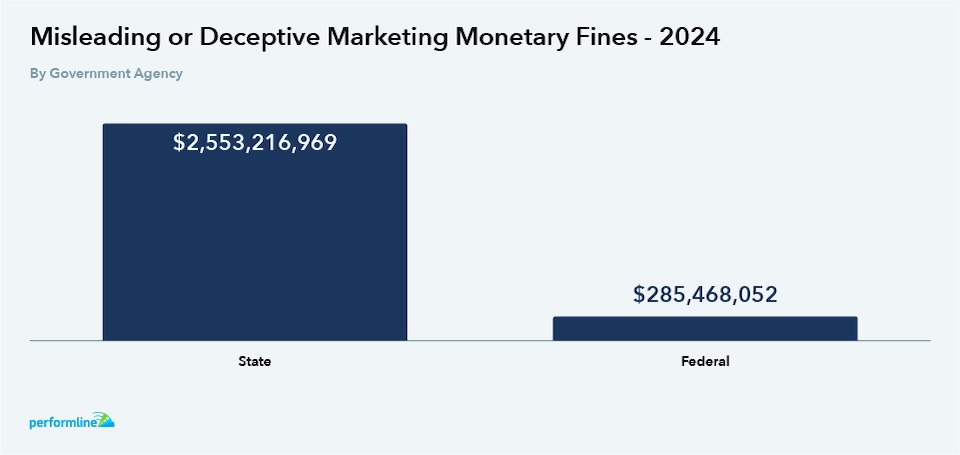

$2.8 billion in fines for misleading marketing practices

The last few years were marked by several enforcement actions related to misleading and deceptive marketing practices.

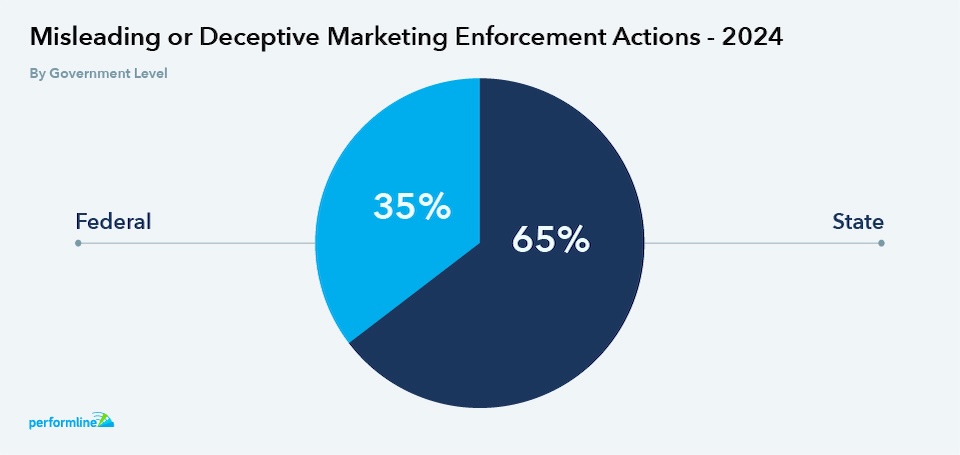

In 2024 alone, regulators issued 67 enforcement actions across various industries, totaling over $2.8 billion in fines.

State regulators took the lead in cracking down on deceptive practices, accounting for 65% of enforcement actions and imposing $2.6 billion in fines, compared to just $285 million from federal regulators—nearly nine times the amount.

And, with federal oversight in flux, state regulators are expected to intensify consumer protection efforts even further in 2025.

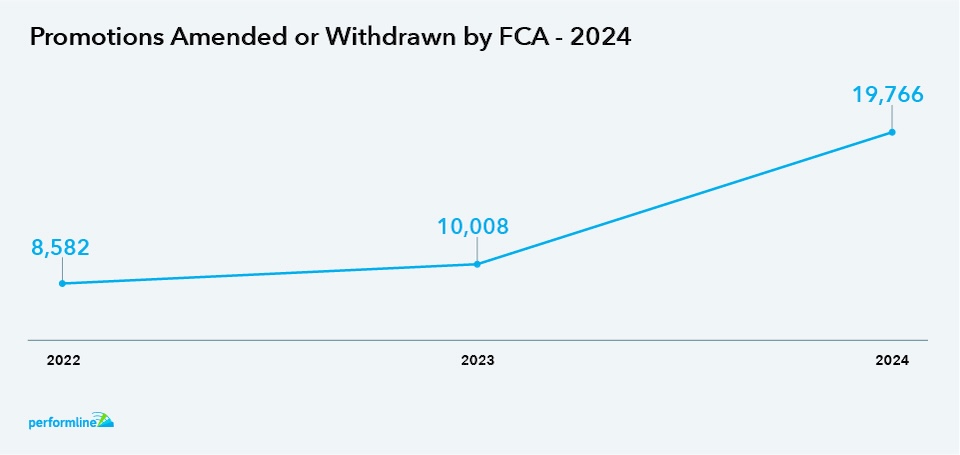

Misleading financial promotions doubled in the U.K. in 2024

The increase in misleading marketing isn’t just a domestic issue.

In the U.K., the Financial Conduct Authority (FCA) has taken a more aggressive stance on financial promotions. In 2024, the FCA intervened in almost 20,000 financial promotions, either requiring amendments or complete withdrawal—nearly double the number from 2023.

This 97.5% increase in interventions demonstrates the FCA’s commitment to ensuring that financial promotions are “clear, fair, and accurate.”

The FCA has made it clear that compliance remains a priority:

“We are still concerned about the levels of compliance with the financial promotions rules and will keep focusing on this area to reduce consumer harm.”

For organizations with a global footprint, this heightened scrutiny means that deregulation in one jurisdiction doesn’t eliminate the need for strong marketing compliance.

Companies must stay compliant with stricter international regulations, especially as global regulators continue ramping up enforcement efforts.

Third-party marketing compliance risks are on the rise

Misleading marketing risks increase significantly when third parties are added to the mix, including affiliates, influencers, and payment processors. Recent enforcement actions make this clear.

FINRA’s $850,000 fine against a fintech for misleading influencer promotions

The Financial Industry Regulatory Authority (FINRA) fined a fintech for failing to supervise misleading social media promotions by influencers.

The influencers made exaggerated and deceptive claims about investing, violating FINRA’s advertising rules.

Despite not creating the content themselves, the fintech was held accountable for allowing misleading promotions to persist.

FTC’s enforcement action against a bill payment company for misleading search ads

The Federal Trade Commission (FTC) took action against a third-party bill payment platform for misleading consumers into thinking they were paying bills directly to service providers.

The company purchased search ads that appeared when consumers looked up a service provider’s name or website. These ads included headlines featuring the provider’s name, creating the false impression that consumers were making payments directly to the intended company.

As a result of these deceptive marketing practices, consumers unknowingly paid millions of dollars in hidden fees, leading to confusion and financial harm.

Why marketing compliance matters, even in a deregulatory era

While some companies assume deregulation means less enforcement risk, the reality is quite the opposite. State regulators, global agencies, and consumer lawsuits are driving a new wave of accountability, even as federal priorities shift.

Here’s why marketing compliance is important no matter what the regulatory landscape looks like.

Consumers expect brands to treat their customers fairly

Once trust is broken, it’s nearly impossible to fully restore. Studies show that consumers who have been misled by one advertisement develop skepticism toward all ads, regardless of the brand.

Research also shows that 88% of U.S. consumers care about how brands behave toward their communities, customers, and employees.

If a brand makes an offer, claim, or representation in its marketing, it must be prepared to fulfill those expectations. Failure to do so can have lasting consequences:

- Bad press spreads fast. Negative headlines can tank consumer confidence overnight.

- Social media amplifies outrage. A single misleading claim can go viral, sparking boycotts and public backlash.

- Consumers don’t forgive easily. Data shows that 50% of consumers will completely lose trust if a brand doesn’t fulfill its promises.

Maintaining transparency and integrity in marketing isn’t just about compliance—it’s essential for protecting brand reputation and customer loyalty.

Regulatory and legal risks are evolving, not disappearing

Even in a shifting regulatory environment, organizations still have to comply with consumer protection laws.

Regulators are still acting aggressively:

- State regulators are stepping up. In 2024, state agencies issued $2.6 billion in fines, nearly nine times the penalties imposed by federal regulators.

- Global agencies are cracking down. The U.K.’s FCA doubled its interventions on misleading financial promotions in 2024, setting a precedent for worldwide enforcement.

- Consumer lawsuits are on the rise. False advertising cases are increasingly being litigated, costing companies millions in settlements and legal fees.

Unknown brand promotions can harm reputations

Marketing compliance isn’t just about following regulations—it’s about knowing what’s being said about your brand.

Misleading ads, false claims, or unauthorized promotions by third parties can erode consumer trust, even if your company isn’t directly responsible.

Without proactive monitoring, brands risk being associated with deceptive practices that confuse or harm consumers.

Staying ahead of unknown brand mentions ensures transparency, protects reputation, and reinforces customer confidence, regardless of the regulatory landscape.

Compliance is a competitive advantage

Some brands treat compliance as a box to check, but the smartest companies use it as a strategic advantage.

Transparency and integrity aren’t just good ethics—they’re good business.

Companies that invest in compliance:

- Build stronger customer relationships by earning trust through clear, honest marketing.

- Reduce financial and legal risks, avoiding costly fines and lawsuits.

- Stay ahead of competitors that cut corners and end up paying the price.

How PerformLine protects brands from marketing compliance risk

Navigating today’s regulatory landscape requires more than manual monitoring. It demands automated, proactive compliance oversight.

Misleading marketing can appear anywhere, sometimes even without your knowledge.

PerformLine helps companies detect and prevent marketing compliance risks before they become costly problems.

With PerformLine, organizations can:

- Discover unknown compliance risks, including unauthorized brand mentions and misleading promotions.

- Monitor content across the web, social media, and emails to quickly spot and flag deceptive or misleading claims.

- Act on any found compliance observations and send remediation notices within a single platform.

Marketing compliance isn’t optional—it’s essential. PerformLine makes it easier, smarter, and more effective so that companies can focus on growth without fear of regulatory or reputational fallout.

Organizations that invest in marketing compliance today will be the ones that thrive tomorrow.

Find out how PerformLine can safeguard your brand—book a demo today.