Using LashBack’s Discovery Tool to Find UDAAP Compliance Violation Examples

Email marketing is a critical aspect of any successful marketing strategy. But did you know that there are laws and regulations in place to protect consumers from unfair, deceptive, or abusive practices in email marketing? These rules fall under the umbrella of UDAAP (Unfair, Deceptive, or Abusive Acts or Practices), and violating them can result in serious consequences for your business.

In this piece, we'll use real examples of UDAAP violations found using LashBack's email discovery tool to show you what UDAAP violations look like in practice and help you avoid them.

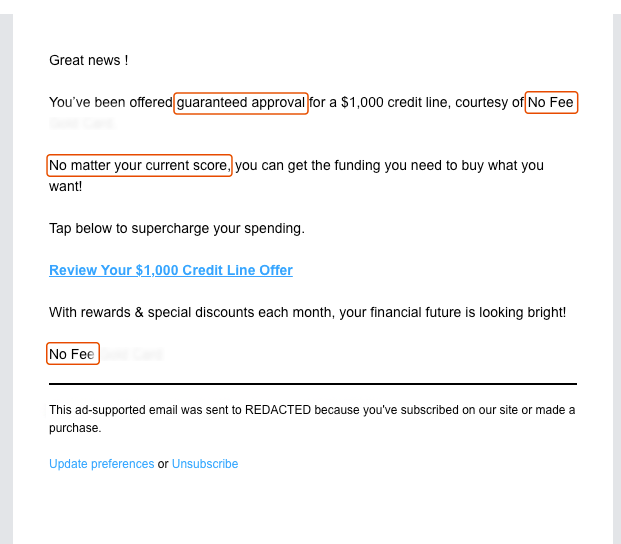

UDAAP Compliance Violation Example #1

What’s wrong with this email?

- Guaranteed approval: While credit card issuers may have different underwriting criteria and standards, the use of the term "guaranteed" implies that all applicants will be approved for a credit line, regardless of their creditworthiness or financial situation. If consumers are led to believe that they will be approved without question but are later denied or subject to additional conditions, this can be considered a deceptive practice.

- No matter your current score: While some credit cards may offer no credit check or limited credit checks, the use of this language can mislead consumers into believing that there will be no credit evaluation at all. In reality, even if a credit check is not performed, the issuer will still review the applicant's financial and personal information to make a credit decision.

- No fee: While there may be no annual fee associated with the card, there could be other fees, such as balance transfer fees, foreign transaction fees, or late payment fees, that are not disclosed. Since these fees are not disclosed, consumers may reasonably believe that they will not incur any fees when using the checking account based on the marketing materials, which isn’t entirely true.

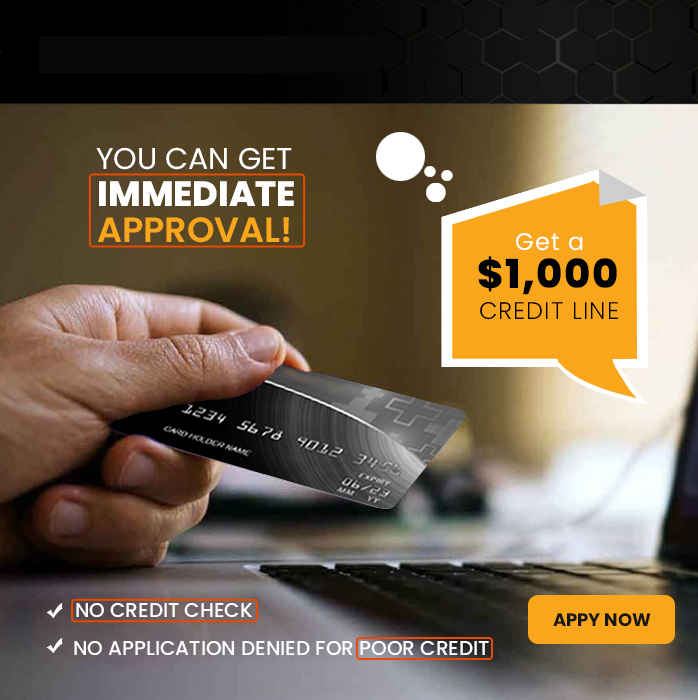

UDAAP Compliance Violation Example #2

What’s wrong with this email?

- Immediate approval: Similar to example #1, this email implies that all applicants will be approved for a credit line, regardless of their creditworthiness or financial situation. This email also promises “immediate” approval. Using the term “immediate” implies that a particular action or outcome will happen instantly, without any delay or waiting period. However, in the context of financial products, there may be certain processes and procedures that need to be followed before an action can be taken or an outcome can be achieved.

- No credit check/poor credit: While some credit cards may offer no credit check or limited credit checks, the use of this language can mislead consumers into believing that there will be no credit evaluation at all. In this particular example, in the fine print of the promotion’s landing page, the company requires a consumer to “be over the age of 18, have a valid debit card or credit card, have the ability to make a monthly payment of $250 if the entire credit line is used and have paid the necessary fees for enrollment.” While there’s no hard credit check, there are still certain criteria for a consumer to meet before they can be approved.

- Failure to disclose additional fees: When you click through to this ad, there are additional fees associated with being approved for this credit line, which includes a $29.95 application fee and a $19.95 maintenance fee for every month after that. This email makes no mention of those additional fees in order for consumers to receive their funds, which could be considered misleading and deceptive.

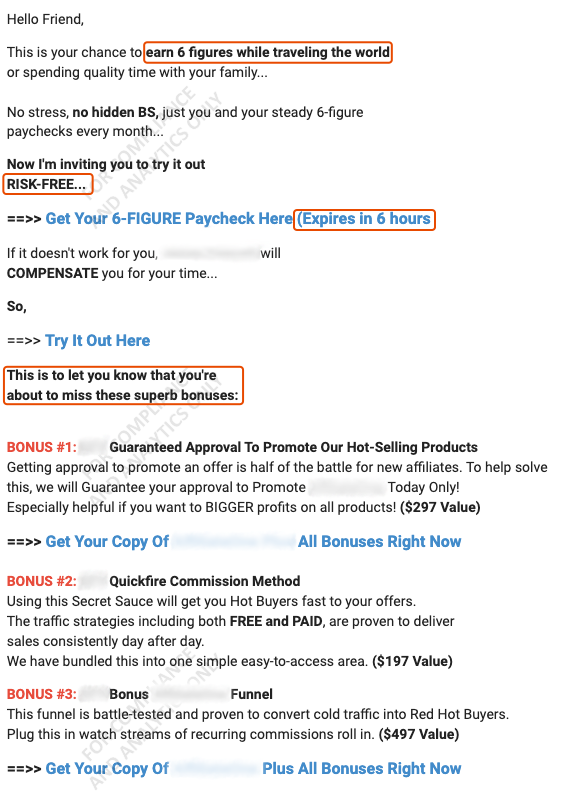

UDAAP Compliance Violation Example #3

What’s wrong with this email?

- Promissory language: The email makes promises to consumers of earning 6 figures while traveling the world or spending quality time with family without disclosing any details about the offer. Plus, most consumers who participate likely won’t earn six figures, so this could be considered deceptive.

- Risk-free: The email offers a "risk-free" opportunity without disclosing what happens if the offer does not work, which could be considered deceptive. For example, if the consumer invests time and effort into the offer and does not see any return, they may not be compensated for their time or effort as promised. Additionally, there could be hidden fees or costs associated with the offer that is not disclosed upfront, which could result in a loss to the consumer.

- Urgency abuse: This email promotes a sense of urgency with the use of language like "expires in 6 hours" and “you’re about to miss these superb bonuses,” which could encourage consumers to make a hasty decision without fully understanding the offer.

- Missing terms and conditions: The email promotes bonuses without clearly stating the value or any terms and conditions associated with them, which could be considered misleading. This lack of transparency could be considered misleading, as consumers may not have a clear understanding of what they are getting in exchange for their time and money.

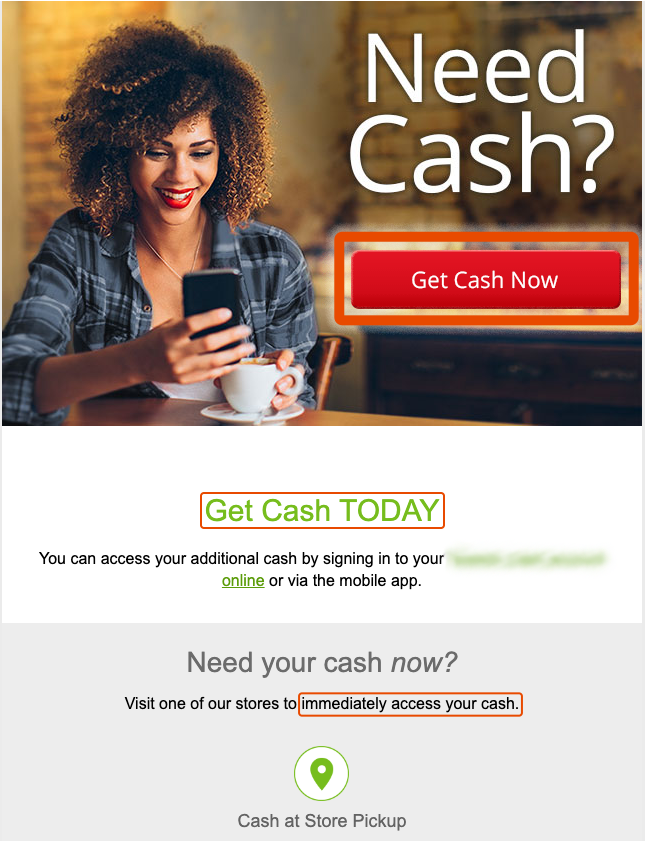

UDAAP Compliance Violation Example #4

What’s wrong with this email?

- Urgency abuse: The email uses phrases such as "Get Cash Now" and "Get Cash TODAY" to create a sense of urgency, which could be seen as deceptive marketing tactics to pressure consumers into taking out a loan before taking the time to fully understand what they’re applying for.

- Immediately: The term "immediately" implies that the consumer will receive the cash instantly or within a very short timeframe. However, in reality, there may be some processing time or delays involved in getting the cash. This term can create false expectations for consumers and make them believe that they will receive their cash much faster than they actually will.

- Lack of terms and disclosures: This email gives very little information about the nature of the loan, the application process, etc. The lack of clear and comprehensive information about the loan and associated fees and charges could be seen as a violation of the UDAAP principles of transparency and fairness in lending practices.

Get more UDAAP compliance insights and examples

Email marketing is just the tip of the iceberg when it comes to UDAAP compliance. To stay ahead of the game, you need to be aware of potential UDAAP compliance issues across all published content.

Check out PerformLine’s latest report that covers the top UDAAP compliance categories and provides real-world examples of non-compliant materials across marketing channels, including the web, social media, and documents.

LashBack Demo

LashBack protects your brand with email compliance and intelligence. Utilize LashBack’s vast set of search criteria and set up custom alerts to notify your organization of any potential UDAAP violations in your email messaging or messages that contain your brand information.

Request a demo here to see the power of LashBack today.